Just the Facts: The Republicans’ “Big Beautiful Bill”

December 2025

Summary: The Republicans’ ”One Big Beautiful Bill” contains a few positive measures, mainly for the highest income Americans, but on balance is harmful to most US households and to our country.

Background on the Bill

The “One Big Beautiful Bill Act” (OBBB) became law on July 4, 2025. The only members of the House and Senate that voted for the OBBB were Republicans. It passed by the narrowest of margins - in the Senate, 50 to 50, with the tie breaking vote cast by the Vice President. In the House of Representatives, the bill passed by 218 to 214. (1,2)

Positives in the OBBB

In fairness, the OBBB has a few positive elements, most of which are tax cuts. These include: (3, 4)

Making the 2017 Tax Cuts Permanent

Raising the deduction for State and Local Taxes (SALT)

Expanding the child tax credit

Eliminating tax on tips and overtime

Expanding Tax Benefits for Family Offices and Small Businesses

These tax cuts benefit higher income households the most. And they add to the deficit, which hurts all of us in the long run.

Negative effects of the OBBB Offsetting these few positives are many more, and more severe, negatives.

These include:

The OBBB massively increases the deficit and the Federal Debt - Tax cuts are not free. The Congressional Budget Office (CBO) estimates the law will raise deficits by over $4 trillion from 2025 to 2034. (5)

The OBBB benefits mostly the wealthiest Americans. The Trump tax cuts from 2017, which overwhelmingly benefit the highest income households, were scheduled to expire, but have been made permanent by the OBBB. (6)

The OBBB guts healthcare and health insurance. To help pay for the tax cuts for wealthy households, the OBBB cuts health care programs by over 1 trillion dollars, pushing approximately 10 million Americans off health insurance. (7)

The OBBB cuts food assistance for struggling families. The OBBB cuts the Supplemental Nutrition Assistance Program (SNAP) by $187 billion through 2034 (about 20 percent). These cuts will increase poverty, food insecurity, and hunger, including among children. (8)

The OBBB increases income inequality.

Middle income households benefit from the tax reductions, but some of that is offset by reductions in other programs.

The lowest income households lose ground, because the tax breaks are not worth much to them and they depend more on the programs being cut or eliminated by the OBBB.

Only households in the top 10% win big - about $12,000 per household, which is more than the total benefit for the other 90% of households. (9)

The OBBB reverses progress on climate change. The OBBB cuts clean energy progress by gutting tax credits and funding that supported hundreds of clean energy projects and related jobs. The bill encourages fossil fuels. Even worse, a new “pay to play” system allows Big Oil to jam through massive polluting projects by simply paying a fee to sidestep environmental rules. The OBBB sells our environment to the highest bidder. (10)

The OBBB funds inhumane attacks on undocumented immigrants. The OBBB includes more than $170 billion over four years for immigration and border security. The law triples ICE’s annual budget. Most of this goes to arresting and deporting immigrants already living in the U.S., most of whom have not committed a crime and many of whom have had lawful status. (11)

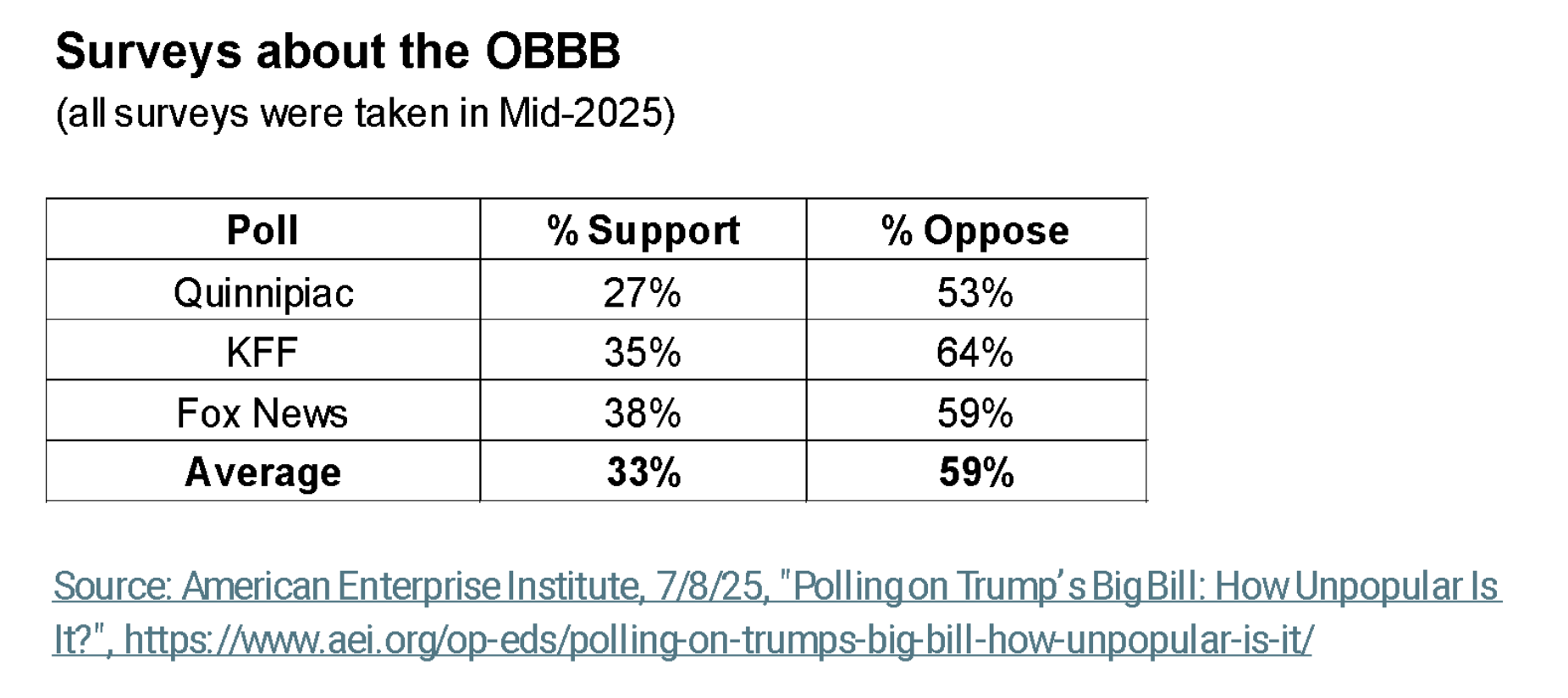

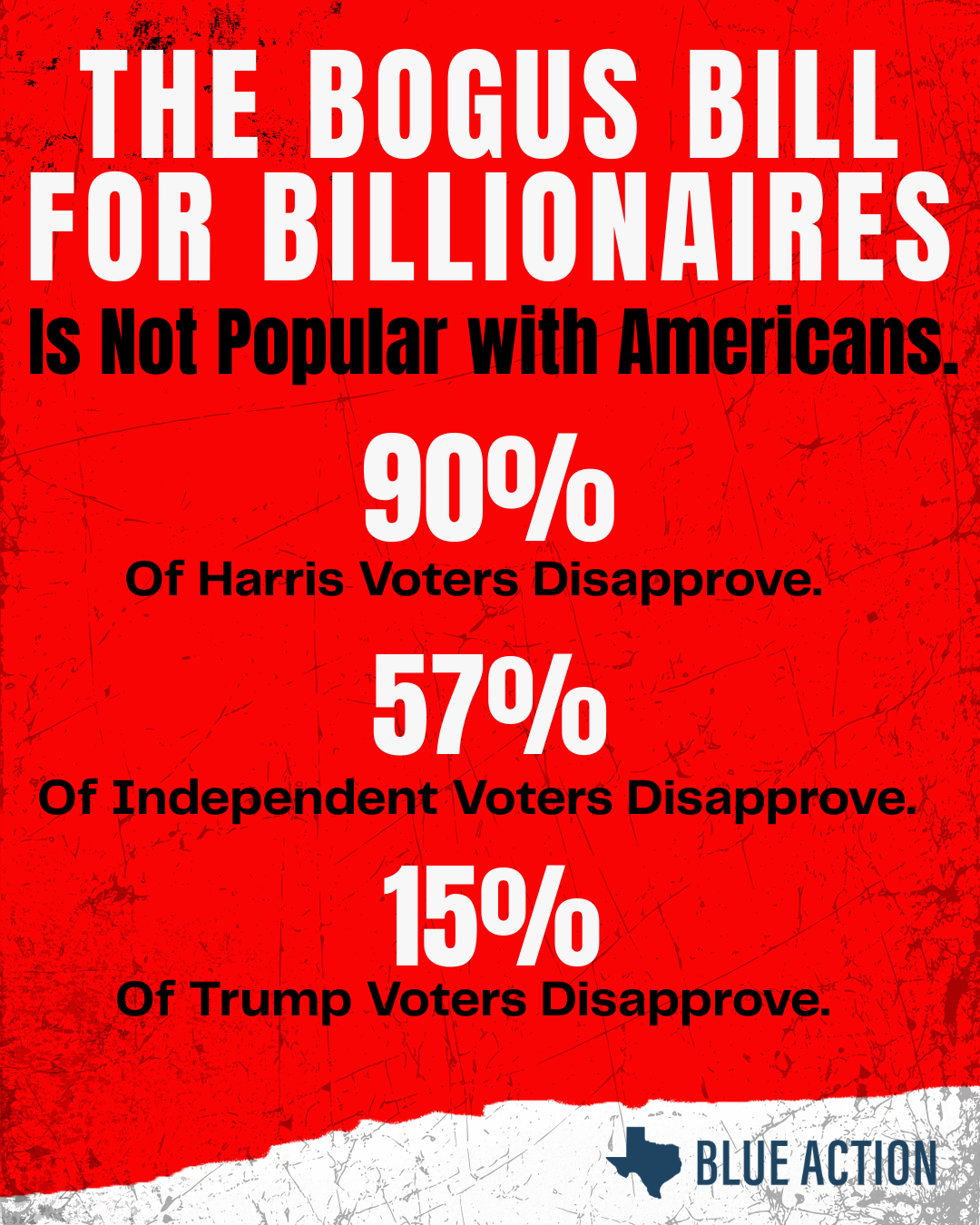

Because of all the damage the OBBB does to our country, it is not surprising that it is not popular with Americans. Multiple surveys have found that about twice as many Americans oppose the OBBB as support it. Even the survey by Fox News found that a solid majority of Americans oppose the Republicans’ OBBB! (12)

The Republicans’ One Big Beautiful Bill is harmful to America and deeply unpopular. We need to elect leaders who will undo this damaging legislation.

Sources

US Senate, https://www.senate.gov/legislative/LIS/roll_call_votes/vote1191/vote_119_1_00372.htm

Congress.gov, https://www.congress.gov/votes/house/119-1/190

H&R Block, https://www.hrblock.com/tax-center/irs/tax-law-and-policy/one-big-beautiful-bill-taxes/

IRS, 7/14/25, https://www.irs.gov/newsroom/one-big-beautiful-bill-act-tax-deductions-for-working-americans-and-seniors

Congressional Budget Office, 7/21/25, https://www.cbo.gov/publication/61570

H&R Block, https://www.hrblock.com/tax-center/irs/tax-law-and-policy/one-big-beautiful-bill-taxes/

Center for Medicare Advocacy, 7/24/25, https://medicareadvocacy.org/impact-of-the-big-bill-on-medicare/

Center on Budget and Policy Priorities, 8/14/25, https://www.cbpp.org/research/food-assistance/by-the-numbers-harmful-republican-megabill-takes-food-assistance-away-from

Congressional Budget Office, 6/12/25, https://www.cbo.gov/system/files/2025-06/61387-Distributional-Effects.pdf

League of Conservation Voters, 7/10/25, https://www.lcv.org/blog/republicans-passed-their-bad-big-beautiful-bill-here-are-the-ugly-impacts-well-see-on-clean-energy-electricity-costs-the-environment-and-more/

Brennan Center, 8/13/25, https://www.brennancenter.org/our-work/analysis-opinion/big-budget-act-creates-deportation-industrial-complex

Source: American Enterprise Institute, 7/8/25, “Polling on Trump’s Big Bill: How Unpopular Is It?”,https://www.aei.org/op-eds/polling-on-trumps-big-bill-how-unpopular-is-it/